DEF 14A: Definitive proxy statements

Published on April 1, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x | |||

|

| |||

|

Filed by a Party other than the Registrant o | |||

|

| |||

|

Check the appropriate box: | |||

|

o |

Preliminary Proxy Statement | ||

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

|

x |

Definitive Proxy Statement | ||

|

o |

Definitive Additional Materials | ||

|

o |

Soliciting Material under §240.14a-12 | ||

|

| |||

|

Trevena, Inc. | |||

|

(Name of Registrant as Specified In Its Charter) | |||

|

| |||

|

| |||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

|

| |||

|

Payment of Filing Fee (Check the appropriate box): | |||

|

x |

No fee required. | ||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

|

|

(1) |

Title of each class of securities to which transaction applies: | |

|

|

|

| |

|

|

(2) |

Aggregate number of securities to which transaction applies: | |

|

|

|

| |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

|

| |

|

|

(4) |

Proposed maximum aggregate value of transaction: | |

|

|

|

| |

|

|

(5) |

Total fee paid: | |

|

|

|

| |

|

o |

Fee paid previously with preliminary materials. | ||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

|

|

(1) |

Amount Previously Paid: | |

|

|

|

| |

|

|

(2) |

Form, Schedule or Registration Statement No.: | |

|

|

|

| |

|

|

(3) |

Filing Party: | |

|

|

|

| |

|

|

(4) |

Date Filed: | |

|

|

|

| |

April 1, 2016

1018 West 8th Avenue, Suite A

King of Prussia, Pennsylvania 19406

Dear Trevena Stockholder:

On behalf of the Trevena, Inc. Board of Directors and our senior management team, we are pleased to invite you to our 2016 Annual Meeting of Stockholders on May 18, 2016. The attached Notice of 2016 Annual Meeting of Stockholders and proxy statement contain important information about the business to be conducted at the Annual Meeting.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. Please review the instructions on each of your voting options described in the Important Notice Regarding the Availability of Proxy Materials. Additional instructions on how to vote can be found on pages 2 through 4 of the proxy statement.

We look forward to seeing you at the Annual Meeting. As always, thank you for your continued support of Trevena.

|

|

Sincerely, |

|

|

|

|

|

|

|

|

Maxine Gowen, Ph.D. |

|

|

President and Chief Executive Officer |

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

|

Date and Time: |

|

Wednesday, May 18, 2016 at 8:30 a.m. |

|

|

|

|

|

Place: |

|

King of Prussia Business Center Board Room |

|

|

|

|

|

Items of Business: |

|

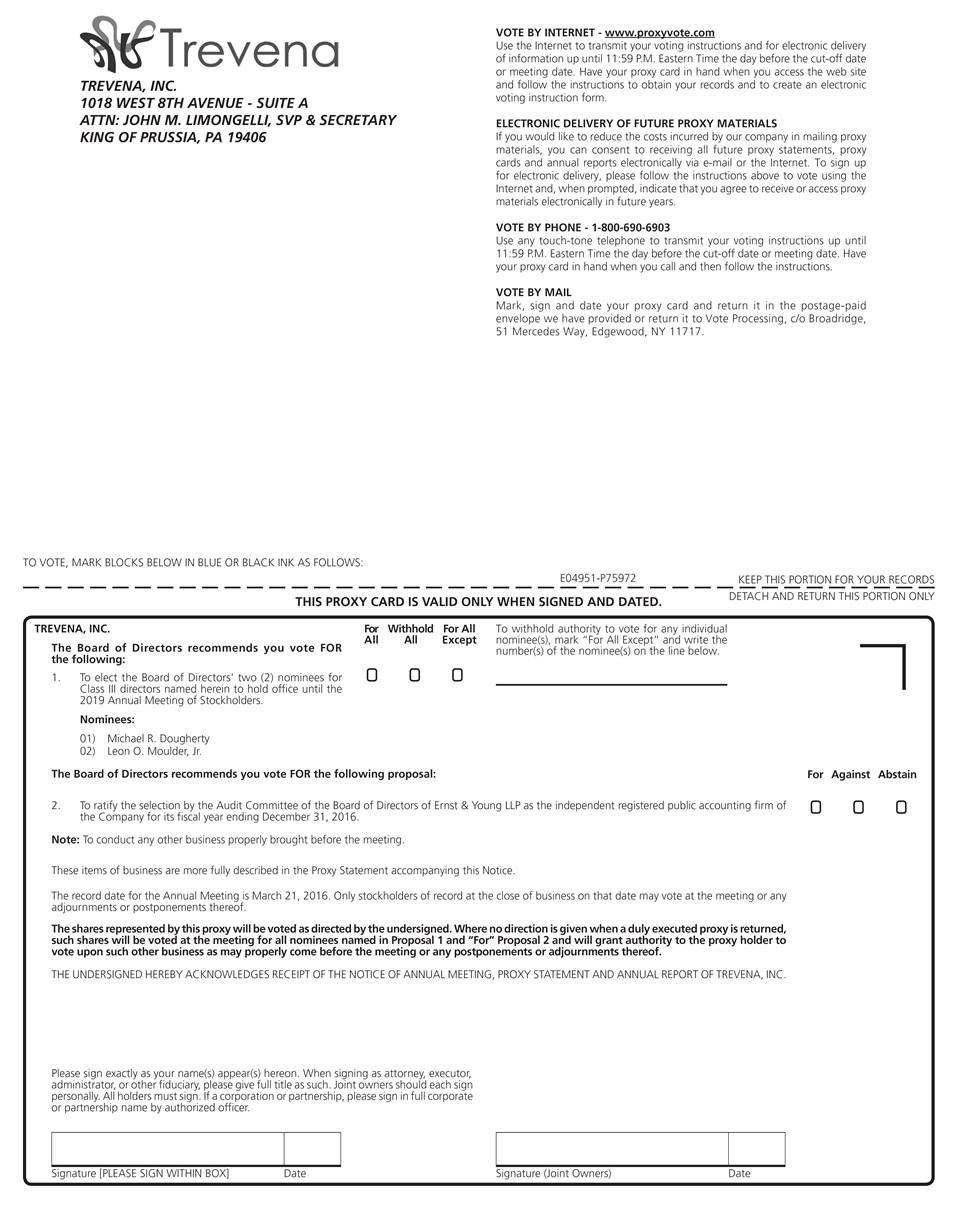

Item 1: Election of the two director nominees named in the proxy statement for terms expiring at the 2019 Annual Meeting of Stockholders.

Item 2: Ratification of the appointment of Ernst & Young LLP as the Companys independent registered public accounting firm for the fiscal year ending December 31, 2016.

Consideration of any other business properly brought before the Annual Meeting. |

|

|

|

|

|

Record Date: |

|

Monday, March 21, 2016. Only Trevena stockholders of record at the close of business on the record date are entitled to receive this notice and vote at the Annual Meeting and any adjournment or postponement of the Annual Meeting.

A list of stockholders of the Company entitled to vote at the Annual Meeting will be available for inspection by any stockholder at the Annual Meeting and during normal business hours at the Companys corporate offices during the 10-day period immediately prior to the date of the Annual Meeting. |

|

|

|

|

|

Proxy Voting: |

|

Your vote is very important, regardless of the number of shares you own. We urge you to promptly vote by telephone, by using the Internet, or, if you received a proxy card or instruction form, by completing, dating, signing and returning it by mail. For instructions on voting, please see Questions and Answers about Voting beginning on page 2. |

|

April 1, 2016 |

|

|

|

|

|

|

By order of the Board of Directors, |

|

|

|

|

|

|

|

|

John M. Limongelli |

|

|

Corporate Secretary |

EACH STOCKHOLDER IS URGED TO VOTE BY COMPLETING, SIGNING AND RETURNING

THE PROXY CARD IN THE ENVELOPE PROVIDED OR BY VOTING VIA THE INTERNET

OR BY TELEPHONE, IN EACH CASE IN THE MANNER DESCRIBED IN THE NOTICE

REGARDING AVAILABILITY OF PROXY MATERIALS. IF A STOCKHOLDER

DECIDES TO ATTEND THE ANNUAL MEETING, HE OR SHE MAY, IF SO

DESIRED, REVOKE THE PROXY AND VOTE THE SHARES IN PERSON.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL STOCKHOLDER MEETING TO BE HELD ON MAY 18, 2016

Our 2016 Notice of Annual Meeting and Proxy Statement and 2015 Annual Report to Stockholders are available at www.proxyvote.com.

Please see Information About the 2016 Annual Meeting beginning on page 1 of this proxy statement for the following information:

· Date, time and location of the 2016 Annual Meeting of Stockholders;

· How to obtain directions to the Annual Meeting;

· How to vote in person at the Annual Meeting;

· An identification of each separate matter to be acted on at the Annual Meeting; and

· The recommendations of our Board of Directors regarding those matters.

|

1 | |

|

1 | |

|

2 | |

|

|

|

|

5 | |

|

5 | |

|

6 | |

|

7 | |

|

8 | |

|

10 | |

|

10 | |

|

10 | |

|

|

|

|

12 | |

|

12 | |

|

13 | |

|

|

|

|

18 | |

|

18 | |

|

18 | |

|

19 | |

|

|

|

|

ITEM 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS |

21 |

|

|

|

|

23 | |

|

|

|

|

24 | |

|

24 | |

|

27 | |

|

28 | |

|

32 | |

|

32 | |

|

|

|

|

35 | |

|

Security Ownership of Certain Beneficial Owners, Directors and Executive Officers |

35 |

|

36 | |

|

|

|

|

37 |

INFORMATION ABOUT THE 2016 ANNUAL MEETING

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

Why did I receive proxy materials? What is included in the proxy materials?

Our Board of Directors is soliciting your proxy to vote at the 2016 Annual Meeting of Stockholders. You received proxy materials because you owned shares of Trevena common stock at the close of business on March 21, 2016, the record date, and that entitles you to vote at the 2016 Annual Meeting of Stockholders.

Proxy materials include the notice of annual meeting of stockholders, the proxy statement and our annual report on Form 10-K for the year ended December 31, 2015 and, if you received paper copies, a proxy card or voting instruction form. The proxy statement describes the matters on which the Board of Directors would like you to vote, and provides information about Trevena that we must disclose under Securities and Exchange Commission (SEC) regulations when we solicit your proxy.

Your proxy will authorize specified persons, each of whom also is referred to as a proxy, to vote on your behalf at the Annual Meeting. By use of a proxy, you can vote whether or not you attend the Annual Meeting in person. The written document by which you authorize a proxy to vote on your behalf is referred to as a proxy card.

We intend to mail these proxy materials on or about April 1, 2016 to all stockholders of record entitled to vote at the Annual Meeting.

How can I get electronic access to the proxy materials?

The proxy materials are available for viewing at www.proxyvote.com. On this website, you may:

· vote your shares after you have viewed the proxy materials; and

· select a future delivery preference of paper or electronic copies of the proxy materials.

You may choose to receive proxy materials electronically in the future. If you choose to do so, you will receive an email with instructions containing an electronic link to the proxy materials for next years annual meeting. You also will receive an electronic link to the proxy voting site.

Rules adopted by the SEC allow companies to send stockholders a notice of Internet availability of proxy materials only, rather than mail them full sets of proxy materials. This year, we chose to mail full packages of proxy materials to stockholders. However, in the future we may take advantage of this alternative notice only distribution option. If in the future we choose to send only such notices, they would contain instructions on how stockholders can access our notice of annual meeting and proxy statement via the Internet. It also would contain instructions on how stockholders could request to receive their materials electronically or in printed form on a one-time or ongoing basis.

If you hold your shares through a bank, broker or other custodian, you also may have the opportunity to receive the proxy materials electronically. Please check the information contained in the documents provided to you by your bank, broker or other custodian.

We encourage you to take advantage of the availability of the proxy materials electronically to help reduce the environmental impact of the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT VOTING

What am I voting on at the Annual Meeting?

|

Proposal |

|

Item |

|

Boards Vote Recommendation |

|

Page |

|

1 |

|

Election of the two director nominees named in this proxy statement for terms expiring at the 2019 Annual Meeting of Stockholders |

|

Vote FOR each of the nominees |

|

12 |

|

2 |

|

Ratification of appointment of Ernst & Young LLP as the Companys independent registered public accounting firm for the fiscal year ending December 31, 2016 |

|

Vote FOR |

|

21 |

Could other matters be decided at the Annual Meeting?

We are not aware of any other matters that will be presented and voted upon at the Annual Meeting. Our 2015 proxy statement described the requirements under our governance documents for properly submitting proposals or nominations from the floor at this years Annual Meeting. The proxies will have discretionary authority, to the extent permitted by law, on how to vote on other matters that may come before the Annual Meeting.

How many votes can be cast by all stockholders?

Each share of Trevena common stock is entitled to one vote on each of the two directors to be elected and one vote on each of the other matters properly presented at the Annual Meeting. We had 52,170,958 shares of common stock outstanding and entitled to vote on March 21, 2016.

How many votes must be present to hold the Annual Meeting?

A majority of the issued and outstanding shares entitled to vote, or 26,085,480 shares, present in person or by proxy, are needed for a quorum to hold the Annual Meeting. Abstentions and broker non-votes (discussed below) are included in determining whether a quorum is present. We urge you to vote by proxy even if you plan to attend the Annual Meeting. This will help us know that enough votes will be present to hold the Annual Meeting.

How many votes are needed to approve each proposal? How do abstentions or broker non-votes affect the voting results?

The following table summarizes the vote threshold required for approval of each proposal and the effect on the outcome of the vote of abstentions and uninstructed shares held by brokers (referred to as broker non-votes). When a beneficial owner does not provide voting instructions to the institution that holds the shares in street name, brokers may not vote those shares in matters deemed non-routine. Only Item 1 below is deemed to be a non-routine matter.

|

Proposal |

|

Item |

|

Vote Required for |

|

Effect of |

|

Effect of Broker Non-Votes |

|

1 |

|

Election of directors |

|

Plurality of votes cast |

|

No effect |

|

Not voted/No effect |

|

2 |

|

Ratification of the appointment of independent auditor |

|

Majority of shares present and entitled to vote |

|

Counted against |

|

Shares may be voted by brokers in their discretion but any non-votes have no effect |

Signed but unmarked proxy cards will be voted for each proposal.

How do I vote if I own shares as a record holder?

If your name is registered on Trevenas stockholder records as the owner of shares, you are the record holder. If you hold shares as a record holder, there are four ways that you can vote your shares.

· Over the Internet. Vote at www.proxyvote.com. The Internet voting system is available 24 hours a day until 11:59 p.m. Eastern Time on Tuesday, May 17, 2016. Once you enter the Internet voting system, you can record and confirm (or change) your voting instructions.

· By telephone. Use the telephone number shown on your proxy card. The telephone voting system is available 24 hours a day in the United States until 11:59 p.m. Eastern Time on Tuesday, May 17, 2016. Once you enter the telephone voting system, a series of prompts will tell you how to record and confirm (or change) your voting instructions.

· By mail. If you received a proxy card, mark your voting instructions on the card and sign, date and return it in the postage-paid envelope provided. If you received only a notice of Internet availability but want to vote by mail, the notice includes instructions on how to request a paper proxy card. For your mailed proxy card to be counted, we must receive it before 8:30 a.m. Eastern Time on Wednesday, May 18, 2016.

· In person. Attend the Annual Meeting, or send a personal representative with a valid legal proxy.

How do I vote if my Trevena shares are held by a bank, broker or custodian?

If your shares are held by a bank, broker or other custodian (commonly referred to as shares held in street name), the holder of your shares will provide you with a copy of this proxy statement, a voting instruction form and directions on how to provide voting instructions. These directions may allow you to vote over the Internet or by telephone. Unless you provide voting instructions, your shares will not be voted on any matter except for ratifying the appointment of our independent auditors. To ensure that your shares are counted in the election of directors, we encourage you to provide instructions on how to vote your shares.

If you hold shares in street name and want to vote in person at the Annual Meeting, you will need to ask your bank, broker or custodian to provide you with a valid legal proxy. You will need to bring the proxy with you to the Annual Meeting in order to vote. Please note that if you request a legal proxy from your bank, broker or custodian, any previously executed proxy will be revoked and your vote will not be counted unless you vote in person at the Annual Meeting or appoint another valid legal proxy to vote on your behalf.

Can I change my vote?

Yes. If you are a record holder, you may:

· Enter new instructions by telephone or Internet voting before 11:59 p.m. Eastern Time on Tuesday, May 17, 2016;

· Send a new proxy card with a later date than the card submitted earlier. We must receive your new proxy card before 8:30 a.m. Eastern Time on Wednesday, May 18, 2016;

· Write to the Corporate Secretary at the address listed on page 37. Your letter should contain the name in which your shares are registered, the date of the proxy you wish to revoke or change, your new voting instructions, if applicable, and your signature. Your letter must be received by the Corporate Secretary before 8:30 a.m. Eastern Time on Wednesday, May 18, 2016; or

· Vote in person (or send a personal representative with a valid proxy) at the Annual Meeting. Note that simply attending the Annual Meeting without voting in person will not, by itself, revoke your proxy.

If you hold your shares in street name, you may:

· Submit new voting instructions in the manner provided by your bank, broker or other custodian; or

· Contact your bank, broker or other custodian to request a proxy to vote in person at the Annual Meeting.

Who will count the votes? Is my vote confidential?

Trevenas Chief Financial Officer, Roberto Cuca, has been appointed Inspector of Election for the Annual Meeting. The Inspector of Election will determine the number of shares outstanding, the shares represented at the

Annual Meeting, the existence of a quorum, and the validity of proxies and ballots, and will count all votes and ballots.

All votes are confidential. Your voting records will not be disclosed to us, except as required by law, in contested Board elections or certain other limited circumstances.

Who pays for the proxy solicitation and how will Trevena solicit votes?

We pay the cost of preparing our proxy materials and soliciting your vote. Proxies may be solicited on our behalf by our directors, officers, employees and agents by telephone, electronic or facsimile transmission or in person. We may choose to enlist the help of banks and brokerage houses in soliciting proxies from their customers and, in all cases, will reimburse them for their related out-of-pocket expenses.

Where can I find the voting results of the Annual Meeting?

We will publish the voting results of the Annual Meeting on a Current Report on Form 8-K filed with the SEC. The Form 8-K will be available online at www.sec.gov within four business days following the end of our Annual Meeting.

IMPORTANT INFORMATION IF YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON

You must be able to show that you owned Trevena common stock on the record date, March 21, 2016, in order to gain admission to the Annual Meeting. Please bring to the Annual Meeting the notice of Internet availability of proxy materials, a printed proxy card, or a brokerage statement or letter from your broker verifying ownership of Trevena shares as of March 21, 2016. You also must bring a valid government-issued photo ID. Registration will begin at 8:00 a.m. Please note that you are not permitted to bring any cameras, recording equipment, electronic devices, large bags, briefcases or packages into the Annual Meeting.

GOVERNANCE POLICIES AND PRACTICES

Trevena is committed to ensuring strong corporate governance practices on behalf of our stockholders. Trevenas Corporate Governance Guidelines, together with the charters of the Audit, Compensation and Nominating and Corporate Governance Committees, establishes a framework of policies and practices for our effective governance. Our Corporate Governance Guidelines, which are available at http://investors.trevenainc.com/corporate-governance.cfm, address Board composition, leadership, performance and compensation, director qualifications, director independence, committee structure and roles, and succession planning, among other things. The Board, the Nominating and Corporate Governance Committee and the other committees regularly review their governance policies and practices and developments in corporate governance and update these documents as they deem appropriate for Trevena.

The following describes some of our most significant governance practices by area.

|

BOARD STRUCTURE AND PROCESS |

|

OVERSIGHT OF EXECUTIVE COMPENSATION |

|

|

|

|

|

· 8 Directors on Board · 7 Independent Directors (87%) · Classified Board Divided into Three Classes · Diverse Board as to Composition, Skills and Experience · Independent Chairman of the Board · Independent Audit, Compensation, and Nominating and Corporate Governance Committees · Annual Self-Evaluations of the Board and its Committees |

|

· Pay-for-Performance Executive Compensation Philosophy · Independent Compensation Consultant to the Compensation Committee · Double-trigger Vesting of Equity on Change of Control · No Tax Gross-up on Change of Control |

|

|

ALIGNMENT WITH STOCKHOLDER INTERESTS |

|

|

|

|

|

|

|

· High Percentage of Variable (at risk) NEO Pay |

|

|

|

· Significant Portion of Director Compensation Delivered in Trevena Common Stock |

|

|

|

· Restrictions on Hedging of Trevena Common Stock |

|

For more information about our executive compensation governance policies and practices, see Executive Compensation beginning on page 24.

ROLE OF THE BOARD AND LEADERSHIP STRUCTURE

The Boards primary role is the oversight of the management of Trevenas business affairs and assets in accordance with the Boards fiduciary duties to stockholders under Delaware law. To fulfill its responsibilities to our stockholders, Trevenas Board, both directly and through its committees, regularly engages with management, promotes management accountability and reviews the most critical issues that face Trevena. Among other things, the Board reviews the Companys strategy and mission, its execution on financial and strategic plans, and succession planning. The Board also oversees risk management and determines the compensation of the Chief Executive Officer (CEO), in consultation with the Compensation Committee. All directors play an active role in overseeing the Companys business strategy at the Board and committee levels. The Board is committed to meeting the dynamic needs of the Company and focusing on the interests of its stockholders and, as a result, regularly evaluates and adapts its composition, role, and relationship with management.

Independent Board Members

Trevena believes in the importance of a board comprised largely of independent, non-employee directors. Currently, the Board has determined that all Trevena directors, other than the Companys CEO, are independent under NASDAQ listing standards and SEC rules. Similarly, at the committee level, all committee members are independent.

Independent Chairman of the Board

We separate the roles of the Chairman of the Board and CEO, and have appointed Leon O. Moulder, Jr., to serve as our independent Chairman. We believe that having a Chairman separate from the CEO helps to ensure independent oversight of the Company and the management team and contributes to strong governance practices. The Board regularly assesses the appropriateness of this leadership structure and has concluded that this structure is appropriate for Trevena at this time. The full Board evaluates the Chairmans performance on an annual basis.

The following table describes the key responsibilities that the Board has delegated to the Chairman of the Board:

CHAIRMAN RESPONSIBILITIES

|

· Serves as principal representative of the Board · Develops schedule and agenda of Board meetings, in consultation with the CEO and other directors · Presides over Board and stockholder meetings · Facilitates discussion among independent directors on key issues · Acts as a liaison between the Board and management |

|

· Advises the CEO on issues of concern for the Board · Leads the Board in CEO succession planning · Engages in the director recruitment process · Represents the Company in interactions with external stakeholders, at the request of the Board |

Risk Oversight

One of the Boards key functions is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines,

including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible.

Trevena employs a number of other practices directed to ensure the highest level of corporate governance oversight on behalf of its stockholders. The following table describes some of these practices in more detail.

PRACTICES DIRECTED TO INDIVIDUAL TREVENA DIRECTORS

|

Limits on Public Company Directorships |

|

The Board does not believe that its directors should be prohibited from serving on boards of other organizations. However, the Nominating and Corporate Governance Committee takes into account the nature of and time involved in a directors service on other boards in evaluating the suitability of individual directors and making its recommendations to the Board. The Company expects that each of its directors will be able to dedicate the time and resources sufficient to ensure the diligent performance of his or her duties on the Companys behalf, including attending board and applicable committee meetings. |

|

|

|

|

|

Change in Directors Principal Position |

|

If a director changes his or her principal employment position, that director is required to tender his or her resignation to the Nominating and Corporate Governance Committee. The Committee will then recommend to the Board whether to accept or decline the resignation. |

|

|

|

|

|

Continuing Education for Directors |

|

The Board is regularly updated on Trevenas businesses, strategies, operations and employee matters, as well as external trends and issues that affect the Company. The Nominating and Corporate Governance Committee oversees the continuing education process and it encourages directors to attend continuing education courses relevant to their service on Trevenas Board. Trevena reimburses directors for expenses they incur in connection with continuing education courses. |

|

|

|

|

|

Attendance at Annual Meeting of Stockholders |

|

The Board expects directors and nominees for director to attend the Annual Meeting. In 2015, eight directors attended the annual meeting. Trevena anticipates that all directors will attend the Annual Meeting in 2016. |

PRACTICES DIRECTED TO TREVENA BOARD PROCESSES

|

Board Executive Sessions |

|

As part of all regularly scheduled Board meetings, the Chairman presides over all executive sessions of the Board, including those sessions held solely with independent directors. At each regularly scheduled meeting held in 2015, the independent members of the Board met in executive session. Each Board committee also met in executive session on a regular basis in connection with their respective meetings. |

|

|

|

|

|

Director Access to Management |

|

Independent directors have unfettered access to members of senior management and other key employees. |

|

|

|

|

|

Independent Advisors |

|

The Board and its committees are able to access and retain independent advisors as and to the extent they deem necessary or appropriate. |

|

|

|

|

|

Management Succession Planning |

|

At the direction of the Chairman, the Board oversees management succession planning. As appropriate, the Board will develop and approve succession plans for the Companys CEO and review and approve succession plans for the Companys senior management together with the input of the Compensation Committee and the CEO. |

|

|

|

|

|

Annual Board Evaluation |

|

Each year, the Nominating and Corporate Governance Committee oversees the self-evaluation of the Board and its committees. Each Board committee also is responsible for conducting a self-assessment to identify potential areas of improvement. On an ongoing basis, directors offer suggestions and recommendations intended to further improve Board performance. |

PRACTICES DIRECTED TO TREVENA STOCKHOLDERS

|

Alignment of Director Compensation |

|

Trevena delivers a significant portion of its non-employee director compensation in the form of options to purchase Trevena common stock. For more information on non-employee director compensation, see page 18. |

|

|

|

|

|

No Stockholder Rights Plan (Poison Pill) |

|

Trevena does not have a stockholder rights plan. |

In 2015, there were 7 meetings of the Board, 12 meetings of the Nominating and Corporate Governance, Compensation and Audit committees of the Board, and 4 meetings of certain special purpose committees of the Board. Overall director attendance at Board and committee meetings in 2015 was approximately 96%. Each director attended 75% or more of the aggregate of all meetings of the Board and committees on which he or she served during 2015. In addition to formal Board meetings, the Board engages with management throughout the year on critical matters and topics.

The Board has the following three standing committees: Nominating and Corporate Governance, Compensation and Audit. In its discretion and subject to Delaware law, the Board and each committee may delegate all or a portion of its authority to subcommittees of one or more of its members. Additional information can be found in the committee charters adopted by the Board and available on Trevenas website at http://investors.trevenainc.com/corporate-governance.cfm. Each committee member meets the independence standards required for the committee on which he or she serves.

|

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

Chair: Julie H. McHugh Other Committee Members: Jake R. Nunn, Anne M. Phillips, M.D.

Meetings Held in 2015: 4

Primary Responsibilities:

· Assisting the Board by identifying qualified candidates for director, assessing director independence and recommending to the Board the director nominees. · Making recommendations to the Board regarding the composition, organization and governance of the Board, including recommendations regarding the membership and chairperson of each Board committee. · Reviewing, advising and reporting to the Board on the Boards membership, structure, organization, governance practices and performance. · Developing, recommending and maintaining a set of Corporate Governance Guidelines applicable to the Company. · Overseeing, together with the Board Chairman, the review and evaluation of the Board and its committees.

|

|

COMPENSATION COMMITTEE

Chair: Barbara Yanni Other Committee Members: Leon O. Moulder, Jr., Anne Phillips, M.D.

Meetings Held in 2015: 4

Primary Responsibilities:

· Approving the Companys long-term strategy of compensation for employees and directors. · Reviewing the corporate goals and objectives applicable to the compensation of the CEO, evaluating the CEOs performance in light of these goals and objectives and, based on this review and evaluation, recommending the compensation of the CEO to the independent members of the Board for approval. · Reviewing and approving the compensation of the Companys executive officers and key senior management, other than the CEO. · Supervising the administration of the Companys equity incentive plans and approving equity compensation awards pursuant to these plans. · Overseeing the management of risks related to the Companys executive and overall compensation, benefits plans, practices and policies. · Maintaining direct responsibility for the appointment, compensation and oversight of the work of any compensation consultant, legal counsel or other external adviser retained by the Committee. |

AUDIT COMMITTEE

Chair: Michael R. Dougherty

Other Committee Members: Adam M. Koppel, M.D., Ph.D., Barbara Yanni

Meetings Held in 2015: 4

Primary Responsibilities:

· Evaluating the performance, objectivity, independence and qualifications of, and retaining or terminating the engagement of, Trevenas independent registered public accounting firm.

· Representing and assisting the Board in fulfilling its oversight responsibilities regarding the adequacy and effectiveness of internal controls, including financial and disclosure controls and procedures, and the quality and integrity of the Companys financial statements.

· Reviewing with management and the independent registered public accounting firm annual and quarterly financial statements, earnings releases, earnings guidance and significant accounting policies.

· Overseeing compliance with material legal and regulatory requirements.

· Overseeing the Companys enterprise risk management program and advising the Board on financial and enterprise risks.

· Maintaining procedures for and reviewing the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submissions by employees and others of any concerns about questionable accounting and auditing matters.

Financial Expertise and Financial Literacy:

The Board has determined that Mr. Dougherty is an audit committee financial expert as defined in the SEC rules, and all members of the Audit Committee are financially literate within the meaning of the NASDAQ listing standards.

The current Board includes seven non-employee directors. To be independent under NASDAQ listing standards, the Board must affirmatively determine that a director has no material relationships with the Company directly, or as an officer, stockholder or partner of an organization that has a relationship with the Company (a Material Relationship). In making its assessment, the Board considers all relevant facts and circumstances, including whether transactions with such organizations are in the ordinary course of Trevenas business and/or the amount of such transactions (in aggregate or as a percentage of the organizations revenues or assets). The Board also considers that the Company may sell products and services to, and/or purchase products and services from, organizations affiliated with our directors and may hold investments (generally, debt securities) in organizations affiliated with our directors. On an annual basis, the Board, through its Nominating and Corporate Governance Committee, reviews relevant relationships between directors, their immediate family members and the Company, consistent with Trevenas independence standards. Trevenas standards, which are detailed in Trevenas Corporate Governance Guidelines available at http://investors.trevenainc.com/corporate-governance.cfm, conform to the independence requirements set forth in the NASDAQs listing standards.

The Board consults with our counsel to ensure that the Boards determinations are consistent with relevant securities and other laws and regulations regarding the definition of independent, including those set forth in pertinent NASDAQ listing standards.

Based on its review of director relationships, the Board has affirmatively determined that there are no Material Relationships between the non-employee directors and the Company and all non-employee directors are independent as defined in both the NASDAQ listing standards (including those applicable to certain board committees) and Trevenas director independence standards.

Trevena is committed to integrity, legal compliance and ethical conduct. All directors and employees, including our executive officers, must comply with the Companys Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics and Trevenas related policies and procedures address major areas of professional conduct, including, among others, conflicts of interest, protection of private, sensitive or confidential information, employment practices, insider trading and adherence to laws and regulations affecting the conduct of Trevenas business. The Code of Business Conduct and Ethics is available on our website at http://investors.trevenainc.com/corporate-governance.cfm.

The Code of Business Conduct and Ethics requires all directors and employees to avoid any conflict or potential conflict between their personal interests (including those of their significant others and immediate family) and the best interests of the Company. Any conflict or potential conflict must be brought to the attention of the Compliance Officer for review and disposition. In addition, directors and officers cannot participate in a personal transaction with Trevena without first notifying and obtaining the approval of Audit Committee in accordance with the Company related person transaction policy described below.

Transactions with Related Persons

Trevena has adopted a written policy that sets forth our procedures for the identification, review, consideration and approval or ratification of related person transactions. For purposes of our policy only, a related person transaction is a transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which we and any related person are, were or will be participants in which the amount involved exceeds $120,000. Transactions involving compensation for services provided to us as an employee or director are not covered by this policy. A related person is any executive officer, director or beneficial owner of more than 5% of any class of our voting securities, including any of their immediate family members and any entity owned or controlled by such persons.

Under the policy, if a transaction has been identified as a related person transaction, including any transaction that was not a related person transaction when originally consummated or any transaction that was not initially

identified as a related person transaction prior to consummation, our management must present information regarding the transaction to our Audit Committee, or, if Audit Committee approval would be inappropriate, to another independent body of our Board of Directors, for review, consideration and approval or ratification. The presentation must include a description of, among other things, the material facts, the interests, direct and indirect, of the related persons, the benefits to us of the transaction and whether the transaction is on terms that are comparable to the terms available to or from, as the case may be, an unrelated third party or to or from employees generally. Under the policy, we will collect information that we deem reasonably necessary from each director, executive officer and, to the extent feasible, significant stockholder to enable us to identify any existing or potential related-person transactions and to effectuate the terms of the policy. In addition, under our Code of Business Conduct and Ethics, our employees and directors have an affirmative responsibility to disclose any transaction or relationship that reasonably could be expected to give rise to a conflict of interest. In considering related person transactions, our Audit Committee, or other independent body of our Board of Directors, will take into account the relevant available facts and circumstances including, but not limited to:

· the risks, costs and benefits to us;

· the impact on a directors independence in the event that the related person is a director, immediate family member of a director or an entity with which a director is affiliated;

· the availability of other sources for comparable services or products; and

· the terms available to or from, as the case may be, unrelated third parties or to or from employees generally.

The policy requires that, in determining whether to approve, ratify or reject a related person transaction, our Audit Committee, or other independent body of our Board of Directors, must consider, in light of known circumstances, whether the transaction is in, or is not inconsistent with, our best interests and those of our stockholders, as our Audit Committee, or other independent body of our Board of Directors, determines in the good faith exercise of its discretion.

Based on this review, there are no related person transactions requiring disclosure under SEC rules.

Compensation Committee Interlocks and Insider Participation

None of our directors who currently serve as members of our Compensation Committee is, or has at any time during the past year been, one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the Board of Directors or compensation committee of any other entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

The Board of Directors is elected by Trevenas stockholders and is divided into three classes, each with a three-year term. There are currently eight members of the Board. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the directors successor is duly elected and qualified.

At the Annual Meeting, the Board is nominating for election by stockholders two directors, each of whom currently is a director of the Company. If elected at the Annual Meeting, each of these nominees would serve until the 2019 Annual Meeting of Stockholders and until her or his successor has been duly elected and qualified, or, if sooner, until the directors death, resignation or removal.

The role of the Board, its leadership structure and governance practices are described above in the Corporate Governance section. This section describes the process for director elections and director nominations, identifies the director responsibilities and qualifications considered by the Board and the Nominating and Corporate Governance Committee in selecting and nominating directors, and presents the biographies, skills and qualifications of the director nominees and those directors continuing in office.

PROCESS FOR SELECTING AND NOMINATING DIRECTORS

The Nominating and Corporate Governance Committee may retain a third-party search firm to assist in identifying and evaluating candidates for Board membership. The Nominating and Corporate Governance Committee also considers suggestions for Board nominees submitted by stockholders, which are evaluated using the same criteria as new director candidates and current director nominees. Instructions for how to submit stockholder nominations to the Board can be found on page 37.

Once a potential candidate has been identified, the Nominating and Corporate Governance Committee reviews the background of new director candidates and presents them to the Board for consideration before selection. When considering director candidates and the current composition of the Board, the Nominating and Corporate Governance Committee and the Board consider how each candidates background, experiences, skills, prior board and committee service and/or commitments will contribute to the diversity of the Board. Candidates interview with the Chair of the Nominating and Corporate Governance Committee and the Chairman of the Board, as well as other members of the Board, as appropriate. The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having strong personal and professional ethics, integrity and values. The Nominating and Corporate Governance Committee also intends to consider additional criteria as follows: relevant expertise upon which to be able to offer advice and guidance to management; sufficient time to devote to the affairs of the Company; demonstrated excellence in his or her field; the ability to exercise sound business judgment; diversity; the commitment to rigorously represent the long-term interests of our stockholders; and independence. In addition, the Board and the Nominating and Corporate Governance Committee will consider the talents, ages, skills, diversity, experience, expertise and such other factors as appropriate given the current needs of the Board and the Company to maintain an appropriate and effective balance of knowledge, experience and capability on the Board as a whole.

The Nominating and Corporate Governance Committee assesses the Boards composition as part of the annual evaluation of the Board. When considering whether to nominate current directors for re-election, the Nominating and Corporate Governance Committee and the Board review the results of the annual evaluation and the qualifications, characteristics, skills and experience that it believes are important for representation on the Board. The Nominating and Corporate Governance Committee and the Board take into consideration these criteria for Trevena directors as part of the director recruitment, selection, evaluation and nomination process. While the Board does not have a formal policy with regard to diversity, the Nominating and Corporate Governance Committee and the Board strive to ensure that the Board is composed of individuals who together possess a breadth and depth of experience relevant to the Boards oversight of Trevenas business and strategy.

Upon the recommendation of the Nominating and Corporate Governance Committee, the Board is nominating the two directors listed below for re-election for terms expiring at the 2019 Annual Meeting of Stockholders. All nominees have consented to serve, and the Board does not know of any reason why any nominee would be unable to serve. If a nominee becomes unavailable or unable to serve before the Annual Meeting, the Board may reduce its size or designate another nominee. If the Board designates a nominee, your proxy will be voted for the substitute nominee.

Below are biographies, skills and qualifications for each of the nominees and for each of the directors continuing in office. Each of the director nominees currently serves on the Board. The Board believes that the combination of the various experiences, skills and qualifications represented contributes to an effective and well-functioning Board and that the nominees and directors continuing in office possess the qualifications, based on the criteria described above, to provide meaningful oversight of Trevenas business and strategy.

The Board of Directors unanimously recommends that stockholders vote FOR the nominees listed below.

|

Independent Chairman of the Board

Director Since: 2011

Age: 58

Board Committee(s): · Compensation |

|

Leon (Lonnie) O. Moulder, Jr.

Mr. Moulder has served as Chairman of our Board since June 2013. Mr. Moulder is Chief Executive Officer and a member of the board of directors of TESARO, Inc., a public oncology-focused biopharmaceutical company that he cofounded in May 2010. From April 2009 to January 2010, Mr. Moulder served as Vice Chairman of the board of directors, President and Chief Executive Officer of Abraxis BioScience, Inc., a biotechnology company. Before that, Mr. Moulder served as Vice Chairman of Eisai Corporation of North America, a pharmaceutical company and wholly owned subsidiary of Eisai Co., Ltd., from January 2008 until January 2009, following Eisai Co., Ltd.s acquisition of MGI PHARMA, Inc., a pharmaceutical company in January 2008. Mr. Moulder served as President and Chief Executive Officer and as a member of the board of directors of MGI PHARMA, Inc. from May 2003 to January 2008. Mr. Moulder earned a bachelor of science degree in pharmacy from Temple University and a master of business administration degree from the University of Chicago. Mr. Moulder is a Trustee of Temple University and serves on the board of the Fox Chase Cancer Center. He also served as a director of Cubist Pharmaceuticals, Inc. from February 2010 until January 2015.

Skills and Qualifications

Our Board believes that Mr. Moulders significant operational and senior management experience in the biopharmaceutical industry, as well as his extensive experience as a director on public and private boards in the industry, allow him to make valuable contributions to the Board. |

|

Independent

Director Since: 2013

Age: 58

Board Committee(s): · Audit (Chair) |

|

Michael R. Dougherty

Mr. Dougherty is the Executive Chairman of Celator Pharmaceuticals, Inc., where he has served in this capacity since August 2015 and as a director since July 2013. Previously, Mr. Dougherty was Chief Executive Officer and a member of the board of directors of Kalidex Pharmaceuticals, Inc., from May 2012 to October 2012. Mr. Dougherty was the President and Chief Executive Officer and a member of the board of directors of Adolor Corporation, a biopharmaceutical company, from December 2006 until December 2011. Mr. Dougherty joined Adolor as Senior Vice President of Commercial Operations in November 2002, and until his appointment as President and Chief Executive Officer in December 2006, served in a number of capacities, including Chief Operating Officer and Chief Financial Officer. From November 2000 to November 2002, Mr. Dougherty was President and Chief Operating Officer of Genomics Collaborative, Inc. Previously, Mr. Dougherty served in a variety of senior positions at Genaera Corporation, a biotechnology company, including President and Chief Executive Officer, and at Centocor, Inc. Mr. Dougherty is currently on the board of directors at Biota Pharmaceuticals, Inc., and Cempra, Inc. Mr. Dougherty received a B.S. from Villanova University.

Skills and Qualifications

Our Board believes that Mr. Doughertys deep understanding of biotechnology finance, research and development, sales and marketing, strategy and operations enable him to make valuable contributions to the Board. |

CLASS I DIRECTORS WHO WILL CONTINUE IN OFFICE UNTIL THE 2017 ANNUAL MEETING

|

Independent

Director Since: 2014

Age: 46

Board Committee(s): · Audit |

|

Adam M. Koppel, M.D., Ph.D.

Dr. Koppel is the Executive Vice President, Corporate Development, and Chief Strategy Officer at Biogen Inc., a global biotechnology company, since May 2014. Before joining that he was a managing director at Brookside Capital, the public equity affiliate of Bain Capital, beginning in 2003. Prior to Brookside Capital, he was an associate principal in the healthcare practice of McKinsey & Company. He is currently on the board of directors of PTC Therapeutics, Inc. Dr. Koppel earned an M.B.A from the University of Pennsylvanias Wharton School, an M.D. and a Ph.D. in Molecular Neurobiology from the University of Pennsylvanias medical and graduate schools, and an M.A. and B.A. in history and science from Harvard College.

Skills and Qualifications

Our Board believes that Dr. Koppels strategic insight, extensive experience as an investor in public healthcare companies, and knowledge as a physician and scientist allow him to make valuable contributions to the Board. |

|

|

|

|

|

Independent

Director Since: 2014

Age: 62

Board Committee(s): · Nominating and Corporate Governance · Compensation |

|

Anne M. Phillips, M.D.

Dr. Phillips currently is Senior Vice President of Clinical, Medical and Regulatory Affairs at Novo Nordisk Inc., a pharmaceutical company, where she has served since 2011. Previously, she served as a Vice President in various positions at GlaxoSmithKline plc, which she joined in 1998, and prior to this Dr. Phillips was Head of the Infectious Diseases Program and Deputy Physician-in-Chief at Wellesley Central Hospital/St. Michaels Hospital in Toronto, Canada. She is a Fellow of The Royal College of Physicians and Surgeons of Canada, earned an MD from the University of Toronto and received a BSc from the University of Western Ontario.

Skills and Qualifications

Our Board believes that Dr. Phillips extensive late-stage clinical development experience in well-established pharmaceutical companies, together with her significant experience and knowledge as a physician, positions her to make valuable contributions to the Board. |

|

Independent

Director Since: 2014

Age: 61

Board Committee(s): · Audit · Compensation (Chair) |

|

Barbara Yanni

Ms. Yanni was Vice President and Chief Licensing Officer at Merck & Co., a pharmaceutical company, from November 2001 until her retirement in March 2014. Prior to this, Ms. Yanni served in various roles at Merck including in corporate development, financial evaluation, and tax. Ms. Yanni currently serves on the Board of Directors of Symic Biomedical, Inc. and Vaccinex, Inc., both private biotechnology companies. Ms. Yanni earned a J.D. from Stanford Law School and an A.B. from Wellesley College. She also holds a Masters of Law in Taxation from New York University.

Skills and Qualifications

Our Board believes that Ms. Yannis extensive experience in biotechnology and pharmaceutical business evaluation and transaction execution, as well as her financial and general business knowledge allow her to make significant contributions to the Board. |

CLASS II DIRECTORS WHO WILL CONTINUE IN OFFICE UNTIL THE 2018 ANNUAL MEETING

|

Management

Director Since: 2007

Age: 58

Board Committee(s): · None |

|

Maxine Gowen, Ph.D.

Dr. Gowen has served as our President and Chief Executive Officer and as a member of our board of directors since our founding in November 2007. Prior to joining our company, Dr. Gowen was Senior Vice President for the Center of Excellence for External Drug Discovery at GlaxoSmithKline plc, or GSK, where she held a variety of leadership positions during her tenure of 15 years. Before GSK, Dr. Gowen was Senior Lecturer and Head, Bone Cell Biology Group, Department of Bone and Joint Medicine, of the University of Bath, U.K. Dr. Gowen has served as a director of Akebia Therapeutics, Inc., a public biopharmaceutical company, since July 2014, and Idera Pharmaceuticals, Inc., a public biopharmaceutical company, since January 2016. From 2008 until 2012, Dr. Gowen served as a director of Human Genome Sciences, Inc., a public biopharmaceutical company. Dr. Gowen also serves on the boards of BIO, the biotechnology industry association, and its affiliate, Pennsylvania Bio. She received her Ph.D. from the University of Sheffield, U.K., an M.B.A. with academic honors from The Wharton School of the University of Pennsylvania, and a B.Sc. with Honors in Biochemistry from the University of Bristol, U.K.

Skills and Qualifications

Our Board believes that Dr. Gowens detailed knowledge of our company and her over 20 years in the pharmaceutical industry, including her roles at GSK, provide a critical contribution to the Board. |

|

Independent

Director Since: 2014

Age: 51

Board Committee(s): · Nominating and Corporate Governance (Chair) |

|

Julie H. McHugh

Ms. McHugh was Chief Operating Officer of Endo Health Solutions Inc., a global specialty healthcare company, from March 2010 to May 2013, and since May 2013 she has provided consulting services to companies in the pharmaceuticals industry. Prior to that, from September 2008 to September 2009, she served as Chief Executive Officer of Nora Therapeutics, Inc., a private biotechnology company. From 2006 to 2008 she was Company Group Chairman for Johnson & Johnsons worldwide virology business unit and from 2004 to 2006 she was President of Centocor, Inc., a Johnson & Johnson subsidiary. Ms. McHugh has served on the boards of directors of Ironwood Pharmaceuticals, Inc., EPIRUS Biopharmaceuticals Inc., and Aerie Pharmaceuticals, Inc., all public pharmaceutical companies, since February 2014, July 2014 and June 2015, respectively. Ms. McHugh also serves on the board of directors of Xellia Pharmaceuticals AS, a private specialty pharmaceutical company.

Skills and Qualifications

Our Board believes that Ms. McHughs deep knowledge of biotechnology strategy, operations, research and development, and sales and marketing allows her to make valuable contributions to the Board. |

|

|

|

|

|

Independent

Director Since: 2013

Age: 45

Board Committee(s): · Nominating and Corporate Governance |

|

Jake R. Nunn

Mr. Nunn has been a Partner at New Enterprise Associates, Inc., a venture capital firm, since June 2006. From January 2001 to June 2006, Mr. Nunn served as a Partner and an analyst for the MPM BioEquities Fund, a life sciences fund at MPM Capital, L.P., a private equity firm. Previously, Mr. Nunn was a healthcare research analyst and portfolio manager at Franklin Templeton Investments and an investment banker with Alex. Brown & Sons. Mr. Nunn currently serves on the board of directors of Dermira, Inc., a public biopharmaceutical company. Mr. Nunn received his A.B. in economics from Dartmouth College and his M.B.A. from the Stanford Graduate School of Business. Mr. Nunn also holds the Chartered Financial Analyst designation, and is a member of the C.F.A. Society of San Francisco.

Skills and Qualifications

Our board of directors believes that Mr. Nunns experience investing in life sciences, specialty pharmaceuticals, biotechnology and medical device companies, as well as his business and financial background, qualify him to serve on our board of directors. |

NON-EMPLOYEE DIRECTOR COMPENSATION

The Compensation Committee reviews and makes recommendations to the Board about the compensation paid to non-employee directors for service on the Trevena Board of Directors. A director who also is an employee of the Company does not receive payment for services as a director. The CEO is the only employee who currently serves as a director.

The Board believes that the current director compensation program:

· aligns with stockholder interests because it includes a significant equity-based compensation component, the value of which is tied to Trevenas stock price; and

· is competitive based on the work required of directors serving on the board of an entity of the Companys size, complexity and scope.

The Compensation Committees charter provides that it will periodically review director compensation and recommend any changes to the Board for its approval. The Compensation Committee may from time to time engage an independent compensation consultant to assist in its review of director compensation.

The Board approved the non-employee director compensation program for 2015 set forth below, effective as of January 31, 2014. Prior to this date, we had not historically paid cash retainers or other compensation with respect to service on our Board of Directors, except for reimbursement of direct expenses incurred in connection with attending meetings of the Board or its committees.

In December 2015, after consultation with Trevenas independent compensation consultant, Radford, the Board approved certain changes to the non-employee director compensation program, effective as of January 1, 2016. As amended, the annual Board retainer for a non-employee director was increased by $5,000, and the retainers for the Nominating and Corporate Governance Committee chair and its members were increased by $1,000 and $1,500, respectively. All other aspects of the cash compensation of non-employee directors remained unchanged. In addition, effective as of January 1, 2016, the number of options awarded to a non-employee director upon initial election to the Board was increased by 12,259 shares to 30,000 shares and the number of options awarded to a non-employee director annually at the annual meeting of stockholders was increased by 6,130 shares to 15,000 shares.

Annual Cash Compensation

The following chart summarizes the retainer compensation provided to non-employee directors for their ongoing service on the Trevena Board during 2015. Cash payments are made in equal, quarterly installments.

|

Retainer type |

|

Annual Amount |

| |

|

Board member |

|

$ |

30,000 |

|

|

Committee member |

|

|

| |

|

· Audit |

|

$ |

7,500 |

|

|

· Compensation |

|

$ |

5,000 |

|

|

· Nominating and Corporate Governance |

|

$ |

3,500 |

|

|

Committee chair (in lieu of Committee Member fee) |

|

|

| |

|

· Audit |

|

$ |

15,000 |

|

|

· Compensation |

|

$ |

10,000 |

|

|

· Nominating and Corporate Governance |

|

$ |

7,000 |

|

In addition to the Board annual retainer, the Chairman of the Board receives a $30,000 cash retainer for his service as Chairman.

Equity Compensation

The equity compensation awards to non-employee directors are made under the 2013 Equity Incentive Plan, as amended (the 2013 Equity Plan). All stock options granted to directors will be nonstatutory stock options, with an exercise price per share equal to 100% of the fair market value (as defined in the 2013 Equity Plan) of the underlying common stock on the date of grant, and a term of ten years from the date of grant (subject to earlier termination in connection with a termination of service as provided in the 2013 Equity Plan).

· Initial Grant. For 2015, on the date of the non-employee directors initial election or appointment to the Board, such non-employee director was granted a stock option for 17,741 shares, subject to appropriate adjustment for any stock split, stock dividend, reverse stock split, stock combination or other change in our capitalization. Commencing on the first date that is three months after the date of grant, the shares subject to each stock option will vest in a series of 12 equal quarterly installments, such that the option is fully vested on the third anniversary of the date of grant, subject to the non-employee directors continuous service through each such vesting date; provided that the vesting date for the quarterly period in which our annual stockholders meeting occurs shall be the date immediately prior to such annual meeting.

· Annual Grant. On the date of the Companys 2015 annual stockholder meeting, each non-employee director who continued to serve as a non-employee director member of the Board immediately thereafter was granted a stock option for 8,870 shares, subject to appropriate adjustment for any stock split, stock dividend, reverse stock split, stock combination or other change in our capitalization. The shares subject to the stock option will vest on the day immediately prior to the next annual stockholders meeting held after the date of grant, subject to the non-employee directors continuous service through such vesting date.

DIRECTOR COMPENSATION TABLE FOR 2015

The table below includes information about the compensation paid to non-employee directors in 2015. Dr. Gowen, the only Company employee on the Board of Directors, does not receive any director compensation for her Board service.

|

|

|

Fees Earned or |

|

Option Awards(2) |

|

Total |

|

|

Name |

|

($) |

|

($) |

|

($) |

|

|

Michael R. Dougherty |

|

45,000 |

|

36,148 |

|

81,148 |

|

|

Adam M. Koppel, M.D., Ph.D. |

|

37,500 |

|

36,148 |

|

73,648 |

|

|

Julie H. McHugh |

|

37,000 |

|

36,148 |

|

73,148 |

|

|

Leon O. Moulder, Jr. |

|

65,000 |

|

36,148 |

|

101,148 |

|

|

Francois Nader, M.D. (1) |

|

20,000 |

|

36,148 |

|

56,148 |

|

|

Jake R. Nunn |

|

33,500 |

|

36,148 |

|

69,648 |

|

|

Anne M. Phillips, M.D. |

|

36,000 |

|

36,148 |

|

72,148 |

|

|

Barbara Yanni |

|

45,000 |

|

36,148 |

|

81,148 |

|

(1) Dr. Nader resigned from the Board effective as of June 30, 2015.

(2) At December 31, 2015, the aggregate number of stock option awards outstanding for each non-employee director was as follows: Mr. Dougherty, 35,481; Dr. Koppel, 26,611; Ms. McHugh, 26,611; Mr. Moulder, 29,836; Mr. Nunn, 17,740; Dr. Phillips, 26,611; and Ms. Yanni, 26,611.

Fees Earned or Paid in Cash

· Represents cash compensation for the retainers described above for the period January 31, 2015 to December 31, 2015.

· Mr. Dougherty served as Audit Committee chair and Ms. McHugh served as Nominating and Governance Committee chair in 2015. Dr. Nader served as Compensation Committee chair until his resignation on June 30, 2015, and Ms. Yanni served as Compensation Committee chair effective as of July 1, 2015; each of Dr. Nader and Ms. Yanni received a pro-rata portion of the annual retainer for the Compensation Committee chair.

· Mr. Moulder served as Chairman of the Board during 2015.

· Dr. Phillips began her service as a member of the Compensation Committee on July 1, 2015 and received a pro-rata portion of the annual retainer for a Compensation Committee member.

Option Awards

This column lists the aggregate grant date fair value of options awarded to directors pursuant to the non-employee director compensation program, computed in accordance with FASB Accounting Standards Codification (ASC) Topic 718, applying the same model and assumptions that Trevena applies for financial statement reporting purposes as described in Note 7 to Trevenas financial statements contained in its Annual Report on Form 10-K for the year ended December 31, 2015 (disregarding any estimates for forfeitures).

ITEM 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Board of Directors Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm retained to audit the Companys financial statements. The Audit Committee approved the appointment of Ernst & Young LLP as Trevenas independent registered public accounting firm for the fiscal year ending December 31, 2016. Ernst & Young LLP has served as Trevenas independent registered public accounting firm since 2007. To assure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of the independent registered public accounting firm. Further, in conjunction with the mandated rotation of the audit firms lead engagement partner, the Chair of the Audit Committee discusses with Ernst & Young LLP the selection of the new lead engagement partner.

The Audit Committee and the Board believe that the continued retention of Ernst & Young LLP to serve as the Companys independent registered public accounting firm is in the best interests of the Company and its stockholders. As a matter of good corporate governance, the Board is seeking stockholder ratification of the appointment even though ratification is not legally required. If stockholders do not ratify this appointment, the Audit Committee will reconsider Ernst & Young LLPs appointment. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time of the year if it determines that such a change would be in the best interests of the Company and its stockholders.

A representative from Ernst & Young LLP is expected to attend the Annual Meeting, may make a statement, and will be available to respond to appropriate questions.

The Board of Directors unanimously recommends that stockholders vote FOR the ratification of the appointment of Ernst & Young LLP as Trevenas independent registered public accounting firm for the fiscal year ending December 31, 2016.

Policy for the Pre-Approval of Audit and Permissible Non-Audit Services

The Audit Committee pre-approves all audit and permissible non-audit services provided by the Companys independent registered public accounting firm, Ernst & Young LLP, pursuant to a written policy. Under the pre-approval policy, the Audit Committee pre-approves specified services in the defined categories of audit services, audit-related services, and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committees approval of the scope of the engagement of the independent registered public accounting firm or on an individual explicit case-by-case basis before the independent registered public accounting firm is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committees members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

The Audit Committee has determined that the rendering of the services below by Ernst & Young LLP is compatible with maintaining the principal accountants independence.

Fees to Independent Registered Public Accounting Firm

Aggregate fees billed for professional services rendered by Ernst & Young LLP for the audit of financial statements for the fiscal years ended December 31, 2015 and December 31, 2014, and fees billed for other services rendered by Ernst & Young LLP during those periods were as follows (in thousands):

|

|

|

2015 |

|

2014 |

| ||

|

Audit Fees |

|

$ |

520,000 |

|

$ |

415,544 |

|

|

Audit-Related Fees |

|

7,000 |

|

21,536 |

| ||

|

Tax Fees |

|

10,000 |

|

10,000 |

| ||

|

All Other Fees |

|

|

|

|

| ||

|

TOTAL |

|

$ |

537,000 |

|

$ |

447,080 |

|

· Audit fees include fees incurred for professional services rendered for the audit of our annual financial statements, the review of quarterly financial statements, filing of registration statements and delivery of auditor comfort letters. For 2015, the increase in audit fees was primarily driven by the filing of an additional registration statement compared to 2014.

· Audit-related fees include assurance and related services that were reasonably related to the audit of annual financial statements and reviews of quarterly financial statements, but not reported under Audit Fees. For 2015, audit-related fees consisted primarily of consultation concerning financial accounting and reporting standards.

· Tax fees include fees incurred in connection with tax advice and tax planning. These services included assistance with tax reporting requirements and audit compliance.

Trevena maintains an independent Audit Committee that operates under a written charter adopted by the Board of Directors. The Audit Committees charter is available on our website at http://investors.trevenainc.com/corporate-governance.cfm. All of the members of the Audit Committee are independent (as defined in the listing standards of NASDAQ and SEC regulations).

Trevenas management has primary responsibility for preparing Trevenas financial statements and establishing and maintaining financial reporting systems and internal controls. Management also is responsible for reporting on the effectiveness of Trevenas internal control over financial reporting. The independent registered public accounting firm is responsible for performing an independent audit of Trevenas financial statements and issuing a report on these financial statements. As provided in the Audit Committees charter, the Audit Committees responsibilities include oversight of these processes.

In this context, before Trevena filed its Annual Report on Form 10-K for the year ended December 31, 2015 (Form 10-K) with the SEC, the Audit Committee:

· Reviewed and discussed with Trevenas management the audited financial statements included in the Form 10-K and considered managements view that the financial statements present fairly, in all material respects, the financial condition and results of operations of Trevena.

· Reviewed and discussed with Trevenas management and with the independent registered public accounting firm, Ernst & Young LLP, the effectiveness of Trevenas internal control over financial reporting as well as managements report on the subject.

· Discussed with Ernst & Young LLP, matters related to the conduct of its audit that are required to be communicated by auditors to audit committees and matters related to the fair presentation of Trevenas financial condition and results of operations, including critical accounting estimates and judgments.

· Received the required communications from Ernst & Young LLP that disclose all relationships that may reasonably be thought to bear on its independence and to confirm its independence. Based on these communications, the Audit Committee discussed with Ernst & Young LLP its independence from Trevena.

· Discussed with each of Trevenas Chief Executive Officer and Chief Financial Officer their required certifications contained in Trevenas Form 10-K.

Based on the foregoing, the Audit Committee recommended to the Board of Directors that such audited financial statements be included in Trevenas Annual Report on Form 10-K for the year ended December 31, 2015 for filing with the SEC.

|

|

AUDIT COMMITTEE: |

|

|

|

|

|

Michael R. Dougherty, Chair |

|

|

Adam M. Koppel, M.D., Ph.D. |

|

|

Barbara Yanni |

The material in this report is not soliciting material, is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Compensation Objectives and Practices

Trevenas pay-for-performance compensation philosophy has the following key objectives:

· Align the interests of the Companys executives with those of its stockholders and reward the creation of long-term value for Trevena stockholders.

· Emphasize performance-based short-term and long-term compensation over fixed compensation.

· Motivate superior enterprise results with appropriate consideration of risk and while maintaining commitment to the Companys ethics and values.

· Reward the achievement of favorable long-term results more heavily than the achievement of short-term results.

· Provide market competitive compensation opportunities designed to attract, retain and motivate highly qualified executives.

To achieve these key objectives, the Compensation Committee uses the following compensation practices, processes and instruments:

· Annual pay-for-performance assessment by the Compensation Committee of the achievement of the Companys corporate goals and an individual executive officers performance.

· A regular analysis of relevant market compensation data for each executive officer.

· An equity-based incentive plan (the 2013 Equity Plan) focused on longer-term stockholder value creation. For example, stock options generally vest over a four-year period, with awards vesting in equal, annual installments from the date of grant.

· A cash-based incentive plan (the Trevena, Inc. Incentive Compensation Plan, or ICP) designed to motivate executive officers to achieve the Companys annual goals.